Form 1120 Schedule O Instructions: A Comprehensive Plan

Schedule O provides crucial supplemental information for Form 1120 filers‚ detailing adjustments‚ specific deductions‚ and credits impacting corporate income tax liability.

Schedule O‚ “Supplemental Information for Form 1120‚” is a vital component of the U.S. corporate income tax return process. It serves as a platform for businesses to provide the Internal Revenue Service (IRS) with detailed explanations and clarifications beyond the standard Form 1120. This form isn’t a standalone return; it must accompany Form 1120 when filing corporate taxes.

Essentially‚ Schedule O allows corporations to elaborate on various items‚ including business activities‚ adjustments to book income‚ specific deductions claimed‚ and tax credits pursued. It ensures transparency and provides the IRS with a comprehensive understanding of the corporation’s financial position and tax calculations. Properly completing Schedule O is crucial for avoiding potential audits or discrepancies.

II. Who Must File Schedule O?

Generally‚ all corporations required to file Form 1120‚ the U.S. Corporation Income Tax Return‚ must also file Schedule O. This includes both domestic and foreign corporations with income taxable in the United States. However‚ the necessity isn’t solely tied to filing Form 1120; specific situations trigger the requirement.

If a corporation has any adjustments to book income‚ claims specific deductions not directly reported on Form 1120‚ or is claiming certain tax credits‚ Schedule O becomes mandatory. Even if no adjustments are needed‚ providing a detailed explanation of primary business activities is often required. Failing to file when required can lead to processing delays or penalties.

III. General Instructions for Schedule O

Schedule O requires clear and concise explanations for all reported items. Use the space provided to detail adjustments‚ deductions‚ and credits‚ referencing relevant documentation when necessary. Ensure all entries are accurate and consistent with the corporation’s financial records; Typewritten responses are preferred‚ but handwritten entries are acceptable if legible.

Corporations should follow a logical order when completing the schedule‚ addressing each section sequentially. Attach additional sheets if the provided space is insufficient‚ clearly labeling each attachment with the corresponding section and part number. Retain copies of Schedule O and supporting documentation for your records‚ as they may be requested during an audit.

IV. Schedule O: Overview of Sections

Schedule O is divided into three primary sections‚ each addressing distinct aspects of corporate tax reporting. Section I gathers supplemental information and other adjustments‚ including details on business activities and noncash charitable contributions. Section II focuses on reconciling book income to taxable income‚ requiring adjustments for items like meals‚ entertainment‚ and depreciation.

Finally‚ Section III details specific deductions and credits‚ such as business expenses not elsewhere included and potential credits like research and development. Each section is further divided into parts‚ guiding taxpayers through a structured reporting process. Careful review of each section is crucial for accurate tax filing.

V. Section I: Supplemental Information

Section I of Schedule O serves as a central repository for details beyond the standard Form 1120. It begins with a request for a comprehensive explanation of the filer’s business activities‚ providing context for the reported income and deductions. This section also addresses rounding amounts‚ ensuring consistency and accuracy in financial reporting.

Furthermore‚ Section I encompasses “Other Adjustments‚” covering items like noncash charitable contributions and political contributions. These adjustments impact taxable income and require detailed explanations. Accurate completion of Section I is vital for a transparent and compliant tax return.

VI. Section I ― Part I: Other Information

Part I of Section I on Schedule O focuses on providing clarifying details about the corporation’s operations and financial practices. A key component is a thorough explanation of the principal business activities‚ detailing what the company does. This narrative helps the IRS understand the nature of the income reported.

Additionally‚ this section addresses the method used for rounding amounts reported on the return. Consistent rounding practices are essential for accuracy. Properly completing Part I ensures the IRS has a clear understanding of the company’s business and its approach to financial reporting‚ minimizing potential scrutiny.

VI.a. Explanation of Business Activities

This section demands a concise yet comprehensive description of the corporation’s primary business endeavors. Avoid vague terms; instead‚ detail the specific products or services offered. For example‚ instead of stating “retail sales‚” specify “sales of women’s apparel and accessories.”

Include information about the industry sector and the target customer base. If the business has evolved during the tax year‚ clearly outline any significant changes in operations. A well-crafted explanation provides context for the reported income and deductions‚ aiding IRS review and potentially reducing audit risk. Clarity is paramount here.

VI.b. Rounding Amounts

The IRS permits rounding of amounts reported on Schedule O‚ but consistency is key. You must round all monetary figures to the nearest dollar. This simplifies reporting and avoids minor discrepancies. However‚ avoid rounding intermediate calculations; perform calculations with full precision and round only the final result.

Clearly indicate your rounding method if it deviates from standard practice. While not strictly required‚ documenting your approach demonstrates diligence. Remember‚ the goal is accuracy and transparency. Consistent rounding throughout the entire Form 1120 and its schedules is crucial for a smooth tax filing process and potential audit defense.

VII. Section I ― Part II: Other Adjustments

Part II of Section I on Schedule O addresses adjustments to income not covered elsewhere. This section accommodates unique financial situations impacting a corporation’s taxable income. Common adjustments include items like income from sources not explicitly addressed in other parts of the form‚ or specific expenses disallowed under current tax law.

Detailed explanations are vital here. Simply stating an adjustment isn’t enough; clearly articulate the nature of the item‚ the calculation used‚ and the relevant tax authority supporting the adjustment. Proper documentation is essential should the IRS inquire. Thoroughness in this section minimizes potential audit issues and ensures accurate tax liability.

VII.a. Charitable Contributions (Noncash)

Noncash charitable contributions require detailed reporting on Schedule O‚ particularly when exceeding certain thresholds. Corporations must meticulously document these donations‚ including a description of the property‚ its date of contribution‚ and the method used to determine its fair market value. Qualified appraisals are often necessary for contributions exceeding $5‚000.

Form 8283‚ Noncash Charitable Contributions‚ may be required as supporting documentation. Accurate valuation is critical; overstating the value can lead to penalties. Ensure the charity is a qualified organization recognized by the IRS. Detailed records‚ including receipts and appraisal reports‚ are essential for substantiating these deductions during an audit.

VII.b. Political Contributions

Reporting political contributions on Schedule O is crucial for corporate tax compliance. Corporations are generally prohibited from directly contributing to political campaigns. However‚ certain expenses related to political activities may be deductible‚ subject to specific limitations and regulations. These often involve trade association dues or lobbying efforts.

Detailed records are paramount‚ documenting the recipient‚ date‚ amount‚ and purpose of any political expenditure. Strict adherence to IRS guidelines is essential to avoid penalties. Schedule O requires a clear explanation of the nature of these contributions and how they relate to legitimate business activities. Consult with a tax professional to ensure proper reporting and compliance.

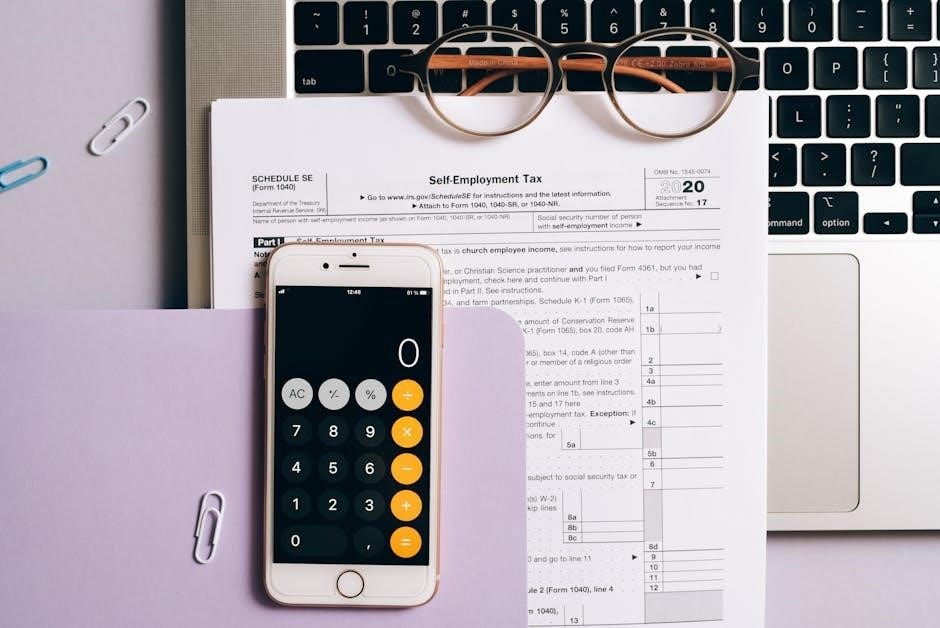

VIII. Section II: Reconciliation of Book Income to Taxable Income

Section II of Schedule O is a critical reconciliation process. It bridges the gap between a corporation’s book income – reported under generally accepted accounting principles (GAAP) – and its taxable income as calculated for federal income tax purposes. This section systematically outlines adjustments needed to arrive at the correct taxable income figure.

These adjustments account for timing differences and permanent differences between book and tax treatments. Common examples include depreciation discrepancies‚ non-deductible expenses‚ and tax-exempt income. Accurate completion of this section ensures the corporation reports its income correctly‚ avoiding potential audits and penalties. Careful documentation supporting each adjustment is vital.

IX. Section II ― Part I: Book Income

Part I of Section II focuses on establishing the corporation’s book income figure. This represents the net income reported on the company’s financial statements‚ prepared according to Generally Accepted Accounting Principles (GAAP). It’s the starting point for the reconciliation process with taxable income.

Corporations directly transfer the net income (or loss) from their books to this section. This figure should align with the income reported on the income statement. Accuracy is paramount‚ as any errors here will cascade through the entire Schedule O. Supporting documentation‚ like the audited financial statements‚ should be readily available for verification purposes during an IRS review.

X. Section II ‒ Part II: Taxable Income Adjustments

Part II of Section II details adjustments needed to reconcile book income to taxable income. These adjustments account for differences between financial reporting and tax law. Common adjustments include items like meals and entertainment expenses‚ depreciation discrepancies‚ and tax-exempt income.

Corporations meticulously list each adjustment‚ clearly indicating whether it increases or decreases taxable income. Proper categorization is vital. For example‚ differing depreciation methods between book and tax require a specific adjustment. Accurate documentation supporting each adjustment is crucial‚ as these are frequent audit targets. This section ensures the correct tax liability calculation.

X.a. Meals and Entertainment Expenses

Reporting meals and entertainment expenses on Schedule O requires careful attention to current tax regulations. Generally‚ only 50% of these expenses are deductible for corporations. Detailed records‚ including dates‚ locations‚ business purpose‚ and attendee names‚ are essential for substantiation.

Specific rules apply to business meals offered at entertainment facilities like clubs or sporting events‚ often facing stricter limitations. The IRS scrutinizes these deductions‚ so accurate categorization and documentation are paramount. Proper reporting ensures compliance and minimizes audit risk. Corporations must clearly identify the portion of expenses qualifying for the deduction.

X.b. Depreciation Adjustments

Depreciation adjustments on Schedule O reconcile book and taxable income differences arising from varying depreciation methods. Corporations often utilize accelerated depreciation for tax purposes (like MACRS) while employing straight-line depreciation for financial reporting. This discrepancy necessitates reporting the adjustment on Schedule O.

Accurate calculation of the difference between book and taxable depreciation is crucial. Include details of assets placed in service‚ depreciation methods used‚ and any Section 179 deductions claimed. Proper documentation‚ including asset lists and depreciation schedules‚ supports the reported adjustment. Failing to accurately report these adjustments can lead to penalties.

XI. Section III: Specific Deductions and Credits

Section III of Schedule O details specific deductions and credits not directly claimed on Form 1120‚ requiring detailed explanations. This section allows corporations to report items impacting their tax liability beyond standard deductions. Careful attention to detail is paramount‚ as these claims often require supporting documentation.

Common items include business expenses not categorized elsewhere‚ officer compensation exceeding certain thresholds‚ and various tax credits like research and development or work opportunity credits. Thoroughly explain the nature of each deduction or credit‚ referencing relevant tax code sections. Accurate reporting minimizes audit risk and ensures proper tax benefits.

XII. Section III ― Part I: Deductions

Part I of Section III on Schedule O focuses on reporting specific deductions that don’t fit neatly into other Form 1120 categories. This section demands a clear and concise explanation for each deduction claimed‚ ensuring transparency and justification to the IRS.

Key items often reported here include business expenses not previously listed‚ potentially involving unique or unusual costs. Additionally‚ detailed reporting of officer compensation is crucial‚ especially if exceeding established limits. Supporting documentation is vital; maintain records substantiating each deduction to avoid potential scrutiny during an audit. Accuracy and completeness are essential for a smooth tax filing process.

XII.a. Business Expenses Not Included Elsewhere

This Schedule O section addresses business expenses legitimately incurred but lacking a dedicated line on the standard Form 1120. It’s a catch-all for costs essential to operations that don’t fit conventional categories‚ demanding detailed descriptions.

Examples include specific legal fees‚ professional service costs beyond accounting‚ or unique industry-related expenses. Thorough documentation is paramount – invoices‚ receipts‚ and clear explanations linking the expense to business activity are crucial. The IRS scrutinizes these claims‚ so clarity prevents issues. Proper categorization ensures accurate taxable income calculation and minimizes audit risk. Remember‚ transparency and justification are key to successful reporting.

XII.b. Officer Compensation

Schedule O requires detailed reporting of officer compensation‚ extending beyond salary to encompass all forms of remuneration. This includes bonuses‚ commissions‚ deferred compensation‚ and non-qualified plan benefits paid to officers – individuals holding key positions within the corporation.

Accurate reporting is vital‚ as excessive or improperly classified compensation can trigger penalties. Clearly identify each officer and the specific amounts paid. Distinguish between compensation paid as wages (subject to payroll taxes) and other forms. Documentation‚ like board meeting minutes approving compensation‚ is essential. Proper disclosure ensures compliance and avoids potential scrutiny from the IRS during an audit.

XIII. Section III ― Part II: Credits

Part II of Section III on Schedule O is dedicated to reporting various business credits that directly reduce your corporation’s tax liability. These credits incentivize specific activities‚ like investment in research and development or hiring individuals from targeted groups.

Common credits claimed here include the Research and Development (R&D) tax credit‚ potentially offering significant savings for innovative companies. The Work Opportunity Tax Credit (WOTC) encourages hiring from specific demographics. Thoroughly review eligibility requirements for each credit before claiming it. Accurate calculation and proper documentation are crucial; maintain records supporting each credit claimed to withstand potential IRS examination.

XIII.a. Research and Development Credit

The Research and Development (R&D) tax credit‚ reported on Schedule O‚ incentivizes companies to invest in innovation. It’s a complex credit with specific requirements; qualifying research must be technological in nature and undertaken for the purpose of creating a new or improved business component.

Eligible expenses include wages‚ supplies‚ and contract research costs. Careful documentation is paramount – maintain detailed records of all research activities‚ expenses‚ and technical personnel involved. The credit calculation involves multiple factors‚ and utilizing the simplified credit method or the alternative simplified credit method may be beneficial. Consult IRS guidance or a tax professional for accurate application.

XIII.b. Work Opportunity Tax Credit

The Work Opportunity Tax Credit (WOTC) encourages businesses to hire individuals from specific targeted groups facing employment barriers‚ reported on Schedule O. Qualifying groups include veterans‚ recipients of Temporary Assistance for Needing Families (TANF)‚ and individuals experiencing long-term unemployment.

The credit amount varies depending on the targeted group and the number of hours worked by the employee. Employers must complete Form 8850‚ pre-screening and certification‚ to determine eligibility. Thorough recordkeeping is essential‚ documenting the employee’s characteristics and work hours. WOTC can significantly reduce tax liability‚ but adherence to IRS guidelines and certification requirements is crucial for successful claim.

XIV. Recordkeeping Requirements for Schedule O

Maintaining meticulous records is paramount when completing Schedule O‚ supporting all reported adjustments‚ deductions‚ and credits. This includes detailed documentation for charitable contributions‚ political contributions‚ and any reconciliation items between book and taxable income.

Specifically‚ retain invoices‚ receipts‚ and supporting schedules for all expenses claimed. For credits like the Research and Development credit‚ keep detailed project records and expense allocations. The IRS may request these records during an audit‚ so organization is key. A robust recordkeeping system demonstrates accuracy and substantiates your tax position‚ minimizing potential penalties.

XV. Common Errors to Avoid on Schedule O

Numerous errors can occur when completing Schedule O‚ potentially leading to IRS scrutiny and penalties. A frequent mistake is miscalculating adjustments to book income‚ particularly regarding depreciation and meals/entertainment expenses. Incorrectly claiming credits‚ like the R&D credit‚ without proper documentation is also common.

Furthermore‚ failing to clearly explain “other information” in Part I can raise red flags. Ensure all amounts are accurately reported and properly rounded. Neglecting to reconcile book and taxable income thoroughly is a significant oversight. Diligence and careful review‚ utilizing available resources‚ are crucial for accurate Schedule O filing.

XVI. Filing Schedule O Electronically

Electronically filing Schedule O‚ alongside Form 1120‚ is generally required by the IRS and offers several advantages. Utilizing approved tax software ensures accuracy and simplifies the process‚ reducing potential errors. The IRS’s e-file system provides immediate confirmation of receipt and faster processing times compared to mail submissions.

Ensure your software supports Schedule O and is updated with the latest tax year forms. Proper transmission requires a valid Preparer Tax Identification Number (PTIN) or Electronic Filing Identification Number (EFIN). Maintaining secure digital records is essential. Electronic filing streamlines compliance and enhances efficiency for corporate tax reporting.

XVII. Resources for Schedule O Assistance

Navigating Schedule O can be complex; fortunately‚ numerous resources are available to assist taxpayers. The IRS Website provides detailed instructions‚ FAQs‚ and relevant publications regarding Form 1120 and its schedules‚ including Schedule O. These online resources are regularly updated with the latest tax law changes.

For personalized guidance‚ Tax Professional Consultation is highly recommended. Enrolled agents‚ CPAs‚ and tax attorneys possess expertise in corporate tax law and can offer tailored advice based on your specific business circumstances. They can ensure accurate completion and maximize eligible deductions and credits‚ minimizing tax liabilities and avoiding potential penalties.

XVII.a. IRS Website

The IRS Website (irs.gov) serves as the primary online resource for all tax-related information‚ including comprehensive guidance on Form 1120 Schedule O. Taxpayers can access official instructions‚ publications‚ and frequently asked questions specifically addressing Schedule O requirements. The website offers downloadable forms and worksheets‚ simplifying the completion process.

Furthermore‚ the IRS provides a searchable database of tax laws‚ regulations‚ and court cases relevant to corporate tax filings. Utilizing the IRS website’s tools ensures access to the most current and accurate information‚ promoting compliance and minimizing errors. Regularly checking for updates is crucial due to evolving tax legislation.

XVII.b. Tax Professional Consultation

Engaging a qualified tax professional—such as a Certified Public Accountant (CPA) or Enrolled Agent—offers significant benefits when navigating Form 1120 Schedule O complexities. These professionals possess in-depth knowledge of corporate tax laws and can provide tailored guidance based on your specific business circumstances.

A tax professional can assist with identifying eligible deductions and credits‚ ensuring accurate reporting‚ and minimizing tax liabilities. They can also represent you in case of an IRS audit‚ offering peace of mind. Consulting a professional is particularly valuable for businesses with intricate financial structures or those experiencing significant changes.

XVIII. Schedule O and Related Forms (1120‚ 1120-S)

Form 1120 Schedule O is intrinsically linked to the core Form 1120‚ the U.S. Corporation Income Tax Return‚ serving as its supplemental statement. It provides detailed explanations and justifications for items reported on the 1120‚ ensuring transparency and compliance.

For S corporations‚ a similar function is fulfilled‚ though utilizing Schedule O with Form 1120-S‚ the U.S. Income Tax Return for an S Corporation. Both forms require accurate completion of Schedule O to support reported figures. Understanding the interplay between these forms is crucial for accurate tax filing and avoiding potential penalties.

XIX. Changes to Schedule O in Recent Tax Years

Recent tax law updates have prompted several revisions to Schedule O‚ demanding diligent attention from corporate filers. While significant structural overhauls haven’t been frequent‚ minor adjustments to reporting requirements occur annually‚ often aligning with broader IRS guidance.

These changes typically involve clarifications to existing lines‚ new disclosure prompts related to emerging tax legislation‚ or modifications to formatting instructions. Staying current with these updates is vital. Tax professionals and the IRS website are essential resources for identifying these alterations‚ ensuring accurate and compliant Schedule O submissions each filing season.

XX. Impact of Tax Law Updates on Schedule O

Tax law updates directly influence Schedule O reporting‚ necessitating careful analysis by corporations. Changes to depreciation rules‚ for instance‚ require corresponding adjustments within Schedule O’s reconciliation of book to taxable income. Similarly‚ modifications to charitable contribution limitations impact Part II disclosures.

The Tax Cuts and Jobs Act of prior years brought substantial changes‚ demanding updated calculations and reporting. Ongoing legislative adjustments‚ like those concerning research and development credits‚ continually reshape Schedule O’s requirements. Proactive monitoring of these updates and professional tax advice are crucial for accurate compliance and maximizing available tax benefits.

XXI. Examples of Schedule O Completion

Illustrative examples demonstrate proper Schedule O completion for diverse corporate scenarios. Consider a manufacturing company claiming a research and development credit; Schedule O’s Part III details qualifying expenses and credit calculations. Another example involves a corporation making significant noncash charitable contributions – Part II requires detailed descriptions and valuation methods.

Furthermore‚ a company with differing book and taxable income due to meals and entertainment expense limitations would reconcile these differences in Section II. These examples highlight the importance of accurate documentation and clear explanations. Reviewing completed schedules provides practical guidance for navigating complex reporting requirements and ensuring compliance.

XXII. Schedule O: Frequently Asked Questions (FAQs)

Common questions regarding Schedule O often center on identifying required disclosures. Many ask‚ “When is Schedule O necessary?” – it’s required when adjustments between book and taxable income exist‚ or specific deductions/credits are claimed. Another frequent inquiry: “What documentation supports Schedule O entries?” – meticulous records‚ including invoices and expense reports‚ are crucial.

Taxpayers also ask about rounding rules and the proper method for reporting noncash charitable contributions. Understanding these FAQs streamlines the filing process and minimizes potential errors. Consulting the IRS website and a qualified tax professional can provide tailored answers to specific situations;

XXIII. State-Specific Considerations for Schedule O

While Schedule O is a federal form‚ state tax implications often necessitate additional scrutiny. Several states don’t fully conform to federal tax laws‚ requiring adjustments to income reported on Schedule O. For instance‚ state depreciation rules might differ‚ impacting taxable income calculations.

Furthermore‚ certain state credits or deductions may require supplemental schedules mirroring Schedule O’s format. Businesses operating in multiple states must carefully navigate these varying regulations. Consulting state tax guidance and potentially a state-specific tax advisor is crucial for accurate reporting and compliance‚ avoiding penalties and ensuring correct tax liabilities.

XXIV. Future Trends in Schedule O Reporting

The landscape of Schedule O reporting is poised for evolution‚ driven by increasing digitalization and tax law complexity. Expect greater emphasis on data standardization and machine-readability to facilitate automated processing by the IRS. Enhanced data analytics will likely lead to more targeted audits focusing on specific Schedule O disclosures.

Furthermore‚ potential legislative changes regarding tax credits – like those for research and development – could necessitate new Schedule O sections or expanded reporting requirements. Staying abreast of IRS guidance and embracing technological solutions for tax compliance will be paramount for corporations navigating these future trends effectively.